Google Employee Makes Millions with "Legal" Insider Trading?

Do insider trading rules apply to prediction markets?

👋 Join thousands of others following and learn more about all the complex and fun legal topics I will cover. Subscribe below!

A public company employee will go to jail and pay huge fines if they are caught trading their company’s stock with material nonpublic information (MNPI).

But if that same employee just buys an “event contract” in the prediction markets on their company’s quarterly earnings results? A gray area that seems like it may be technically legal based on current laws…

That makes total sense, right?

Employees and Prediction Markets

Every so often, a new behavior shows up in the workplace that makes lawyers stop mid-sentence and say, “Wait…people can do that now?”

Prediction markets are one of those things.

Prediction markets let people place real-money bets on real-world outcomes. Product launches. Regulatory approvals. Court decisions. Elections. Sometimes things that are being actively discussed in internal meetings earlier that same day.

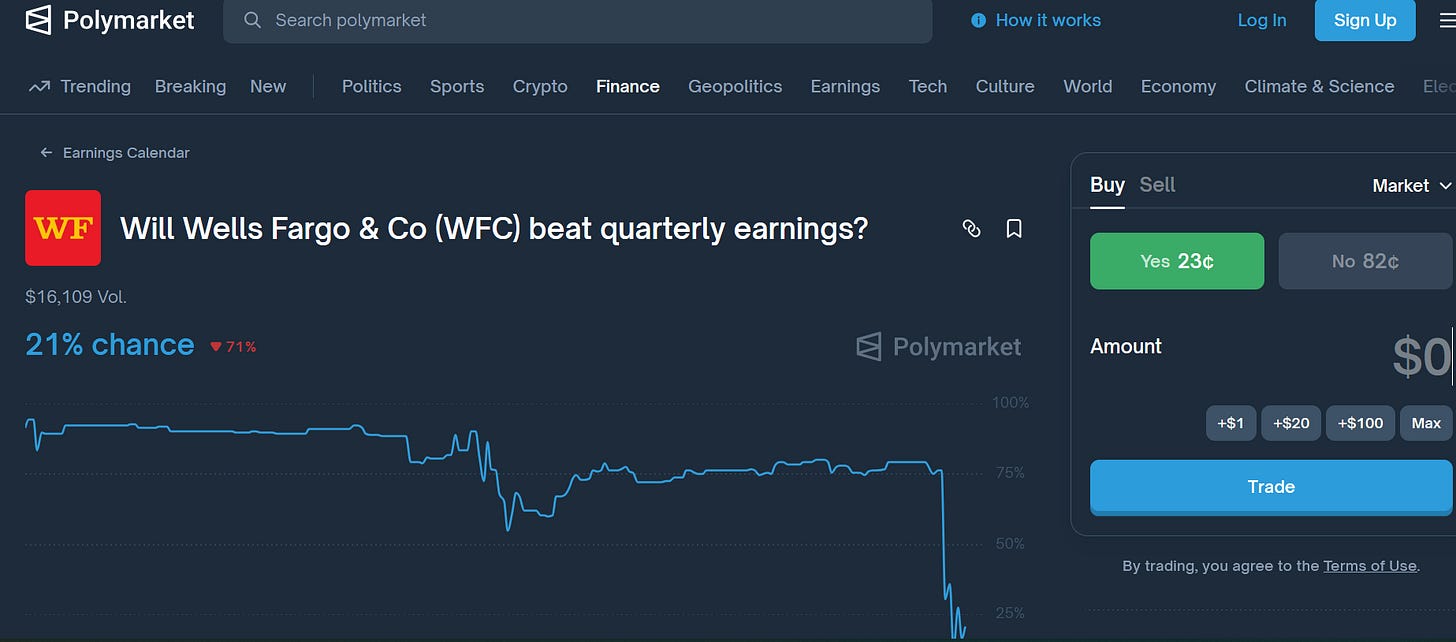

For example, you can bet on all major public company earnings.

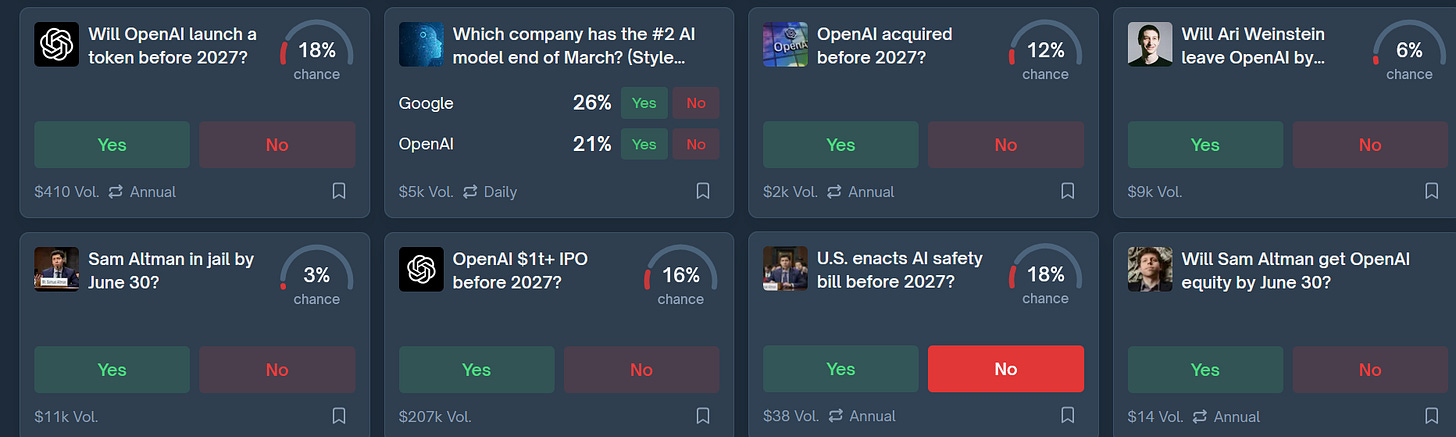

You can also bet on a variety of tech news. Below are just a few that involve OpenAI. Like “Will Sam Altman be in jail by June 30th?” 🤣

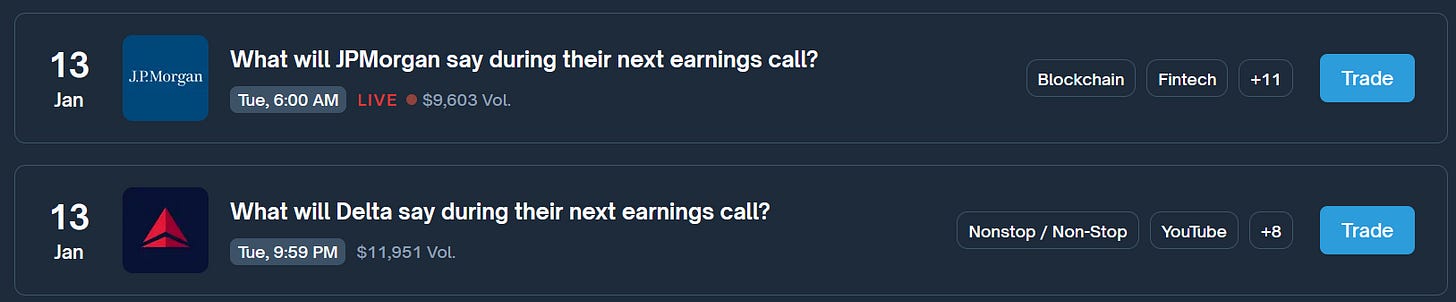

You can even bet on what words will be said on an earnings call.

Last quarter, the CEO of Coinbase pulled up the prediction market word list and read them all out at the end of their earnings call…

None of this is currently covered in your employee handbook…

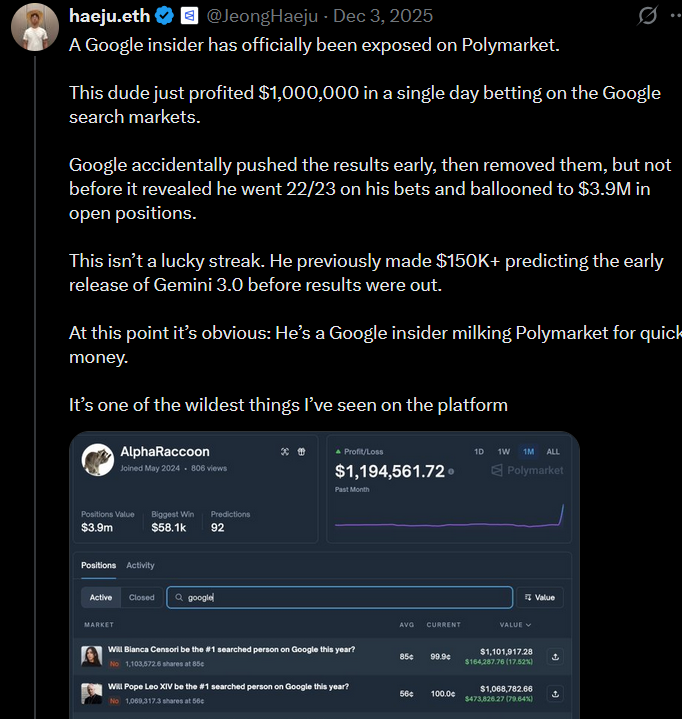

Google Insider Allegedly Made $3.9M in Prediction Market

Recently, there’s been a lot of online discussion accusing a tech employee of betting on internal product milestones and Google search markets. And this person has made a TON of money from it.

Is this legal? If this person is a Google insider, would they be charged with insider trading?

Do Insider Trading Rules Apply to Prediction Markets?

Prediction markets don’t fit neatly into any familiar legal box.

Insider trading laws are built around securities. It assumes brokerage accounts, trades, issuers, blackout windows, and a paper trail everyone pretends to understand.

Prediction markets skip all of that. There’s no stock. No company issuing anything. Just an event, a wager, and a payout.

So when someone asks whether betting on an internal outcome is illegal, the answer is rarely a clean yes or no. It’s more of a long pause followed by, “I need to think about how bad this looks.”

Prediction markets (like Polymarket) treat their event contracts as derivatives regulated by the Commodity Futures Trading Commission (CFTC), not as securities under SEC jurisdiction. Classic insider trading laws (like SEC Rule 10b-5) primarily apply to securities, prohibiting trades on material nonpublic information (MNPI) in breach of a duty. Prediction market contracts generally don’t qualify as securities though…so those strict prohibitions don’t directly carry over.

The CFTC does have anti-fraud rules under the Commodity Exchange Act, which prohibit manipulative or deceptive devices, including trading on MNPI obtained through fraud, deception, or in breach of a pre-existing duty. However:

This is a narrower standard than SEC rules.

It requires proving elements like breach of fiduciary duty or fraud in obtaining/using the info.

In practice, the CFTC has rarely (if ever) enforced insider trading specifically on event contracts in prediction markets.

Multiple reports and legal analyses describe this as a regulatory gray area, with no blanket ban on using insider info for these bets.

Corporate Policies Were Written for a Different Era

Most insider trading and ethics policies assume that personal profit comes from buying or selling stock. They do a decent job with that.

They do not contemplate employees placing bets on whether their own team hits a deadline or whether a regulator approves something they helped prepare.

That leaves Legal in the awkward position of explaining why something feels wrong even though there’s no sentence in the policy that says, “Please do not gamble on your own work.”

Policies age. Behavior evolves. This is one of those gaps.

Some Jobs Make This Instantly Weird

Context typically matters here.

An employee betting on whether it rains next Tuesday is not the issue.

An employee betting on outcomes they help shape is.

People in finance, engineering, legal, regulatory, compliance, government affairs, and leadership tend to know things before the rest of the world does. Sometimes they’re the reason those things happen at all.

When someone in that position places a wager tied to their work, it stops being clever and starts being uncomfortable.

Even if nothing illegal happened, everyone’s confidence in the system takes a hit.

Regulators Will Eventually Notice

Prediction markets already have regulators watching them, mostly from a commodities and gaming angle. That focus won’t stay narrow forever.

Regulatory frameworks tend to expand when behavior starts producing uncomfortable outcomes. If employees regularly profit from inside knowledge through unconventional channels, enforcement theories will adapt.

Nobody wants their company to be the example cited in the footnote of the first case.

Even the major prediction market platforms (Kalshi and Polymarket) are inconsistent in their rules:

Kalshi: Explicitly bans insider trading and anyone with material nonpublic information trading on contracts

Polymarket: Has been more lenient with no explicit insider trading ban. Many think insider trading improves accuracy and timeliness of information.

What Companies Are Starting to Do

This doesn’t require overreaction or dramatic policy rewrites. It does require decisions.

Some companies are:

treating prediction market activity like securities trading for certain roles

declaring specific topics off-limits

folding it into conflict-of-interest rules

setting expectations before someone pushes the boundary

While some may call it paranoia, it’s better to describe it as governance catching up.

Final Thoughts

Eventually, companies will address this through policies, enforcement, or very awkward explanations they wish they’d avoided.

Regulators are also already circling. Expect more government guidance and regulations in the coming months and years.

I expect what continues to happen is people view insider trading in prediction markets as basically legal (although gray) and since it’s much harder to catch, all the illegal activity will just move over to prediction markets until the rules change (both government regulations and company policies).

My ethical warning: Ask yourself, “How would I feel if my trading and bets were published for the world to see?”.

Disclosure: *This is not legal advice, investment advice, tax advice, or financial advice.

Well this sounds not okay.. But there is a legit way to ride the wave

https://open.substack.com/pub/jarviscapitalresearch/p/the-only-signal-that-matters-insider?r=6qs9m8&utm_campaign=post&utm_medium=web