When the Base Model Eats the Business Model

A sober(ish) look at why so many AI applications are suddenly sweating

👋 Get the latest legal insights, best practices, and breakdowns. I cover everything tech companies need to know about legal stuff.

In the last year, a quiet shift has been happening in AI. It’s the kind of shift that causes investors to frown at spreadsheets, product leaders to stare into the middle distance, and lawyers to wonder whether they should start brushing up on restructuring clauses again.

Here it is: Foundation models are improving so quickly that many AI applications built on top of them no longer have a defensible advantage.

Not in the abstract. Not hypothetically. Right now.

And nowhere is this clearer than in legal tech.

Let’s walk through two examples that tell the entire story without naming the 47 other companies quietly experiencing the same thing.

1. Harvey: The billion-dollar legal AI that suddenly has competition from…Word

Harvey raised north of $1 billion, became the industry’s favorite topic at legal conferences, and positioned itself as the future of legal work.

But in the last six months, conversations among lawyers have started to sound like this:

“Our lawyers are just using Copilot and it’s close enough.”

“Litera rolled out similar features, and, inconveniently, they’re free.”

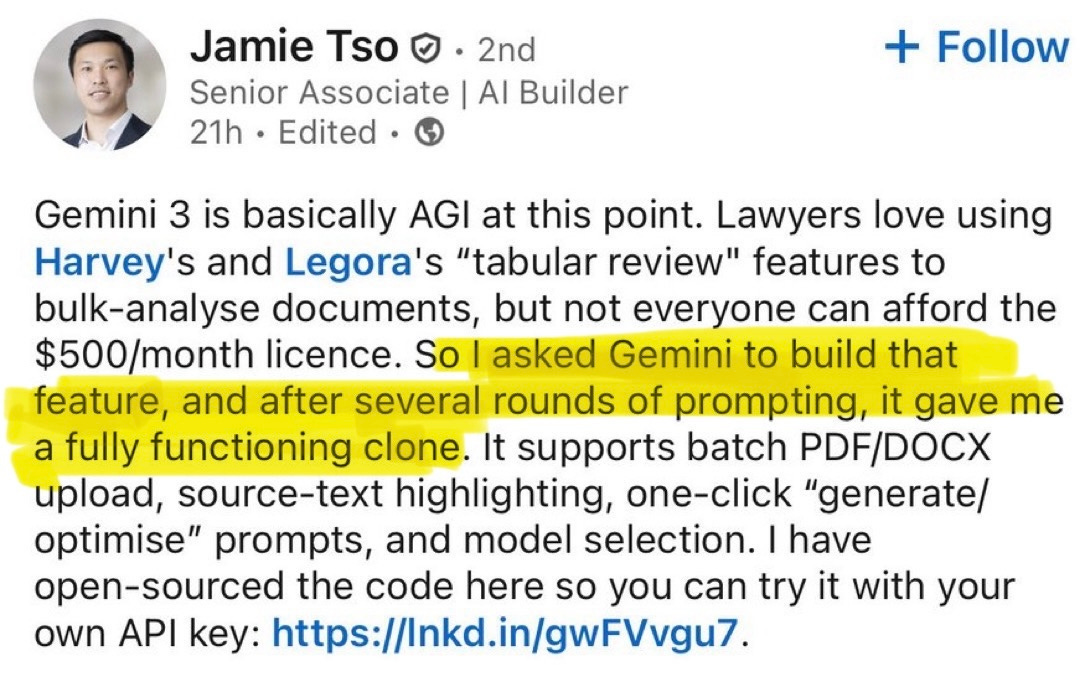

“I vibe-coded the features I need”

“Usage numbers are…lower than anticipated.”

None of this is a moral judgment on Harvey’s team.

They built something impressive.

The problem is simple: The newest foundation models (GPT-5.1, Claude, and friends) are now so capable that the “specialized legal AI” gap has narrowed to a sliver.

Once Microsoft bundles that capability into a product firms already pay for, CFOs start asking dangerous questions like: “Remind me why we have two tools that do the same thing?”

Some firms are locked into multi-year contracts signed during peak AI euphoria.

But renewal cycles are coming, and they’re going to be educational.

2. Casetext / CoCounsel: A $650M acquisition colliding with a rapidly moving floor

Thomson Reuters bought Casetext for $650 million, which was a rational decision at the time. CoCounsel was ahead of everyone else. It worked. Lawyers liked it.

Then the model layer leveled up…dramatically.

And suddenly:

The base models outperform CoCounsel on standard legal tasks

Customers begin shifting back to general-purpose tools

TR starts investing in native foundation model integrations

CoCounsel didn’t fall behind; the ground moved faster than anyone expected.

It’s hard to maintain a moat when the river doubles in speed every quarter.

3. This is happening across every industry

Legal just happens to be the most obvious current example.

But the same pattern is occurring in:

sales automation

compliance workflows

research and summarization tools

customer support

healthcare triage

coding assistants

contract analytics

financial modeling assistants

Startups built thin wrappers around foundation models.

They raised large rounds.

They sold a compelling story.

Then the base models matured faster than projected, making those wrappers look a lot more like features than defensible products.

Unless a company has:

proprietary datasets

deep operational integration

regulatory insulation

or its own model innovation

…it’s vulnerable.

“Fine-tuning” doesn’t count as a moat.

4. The business consequences are already here

This shift isn’t theoretical. It’s showing up in contracts, budgets, roadmaps, and leadership meetings.

Long-term AI contracts suddenly feel like outdated gym memberships: Everyone signed up with enthusiasm. Now many are quietly wondering how to cancel.

Acquisition valuations look more fragile: When a $650M purchase now competes with a free feature inside a productivity suite, the math changes.

Shadow AI becomes unavoidable: Employees migrate toward whatever tool actually works best, not necessarily the one with procurement’s stamp of approval.

Vendor stability is harder to assess: When product differentiation depends on staying ahead of the next model release, vendor viability becomes a moving target.

This isn’t anyone’s fault. It’s the market adjusting to a world where innovation cycles are measured in months, not years.

5. Is this an AI bubble? A controlled correction? Something in-between?

It’s not a bubble in the “this tech is fake” sense. The tech is breathtakingly real.

But the valuations placed on vertical AI apps assumed a slower, more predictable evolution of the underlying model layer.

That assumption didn’t hold.

The result is a correction (smooth for some, bumpy for many).

The apps that survive will be the ones with:

real data advantages

workflow lock-in

measurable performance superior to base models

or distribution channels foundation models cannot easily replace

Everything else gets squeezed.

6. Practical implications for companies deciding what to build or buy

A few principles are emerging:

Compare every vertical AI tool to the newest base model before buying. The results will surprise you.

Avoid long-term commitments. Three-year AI contracts age like dairy.

Design workflows that can tolerate tool churn. The tool you use today may not be the tool you use in six months.

Guard data portability like a critical asset. It’s the only thing that lets you switch vendors without a migraine.

Assume rapid capability changes. Plans that rely on model stability are really just wishful thinking in a trench coat.

Final Thought

We’re in an era where: The more powerful foundation models become, the more they erase the products built directly on top of them.

This isn’t catastrophic. It’s simply reality catching up to the hype.

Some AI applications will thrive because they deliver value that persists beyond the model layer. Many won’t.

The smartest organizations aren’t trying to predict the winner. They’re building flexible systems that can adapt as the foundation shifts beneath them.

Because in AI, the ground is always moving and the companies that stay upright are the ones that expect it.

Scary 😱!

But exciting too!

Vertical apps are still going to be a thing and a great place to be — but probably the ones that do best are the niche-iest that the LLMs themselves won’t bother with… and/or that it will be too time-consuming or where the domain-specific data and workflow just aren’t as harvestable in the public domain.

Argues to focus…

We humans need to find our spots in this brave new world. Yikes!

Experiencing this in real time. We have a partnership with a Legal AI vendor, but I find myself using Google Gemini more often. It’s a wrap once they develop a repository feature that can batch audit and review files and contracts (if they haven’t already).